PitGrowth × Financial Technology

Redefining how money moves. We connect banks, corporates, and startups with innovative financial technologies that enable faster, safer, and smarter transactions.

The old way

Digital Banking Platforms

Providing next-generation banking solutions tailored for retail and corporate clients, focusing on seamless omnichannel experiences.

Payments & Transfers

Delivering solutions for real-time, efficient cross-border transactions and advanced mobile payment infrastructure.

Lending & Credit Platforms

Developing innovative online lending models, Buy Now Pay Later (BNPL) services, and advanced credit scoring technologies.

WealthTech & Investment Platforms

Implementing robo-advisors, sophisticated trading tools, and integrated portfolio management systems for investors.

RegTech & Compliance

Specialized solutions encompassing fraud detection, Anti-Money Laundering (AML) processes, and streamlined regulatory reporting.

Explore More

Discover all solution categories in Financial Technology

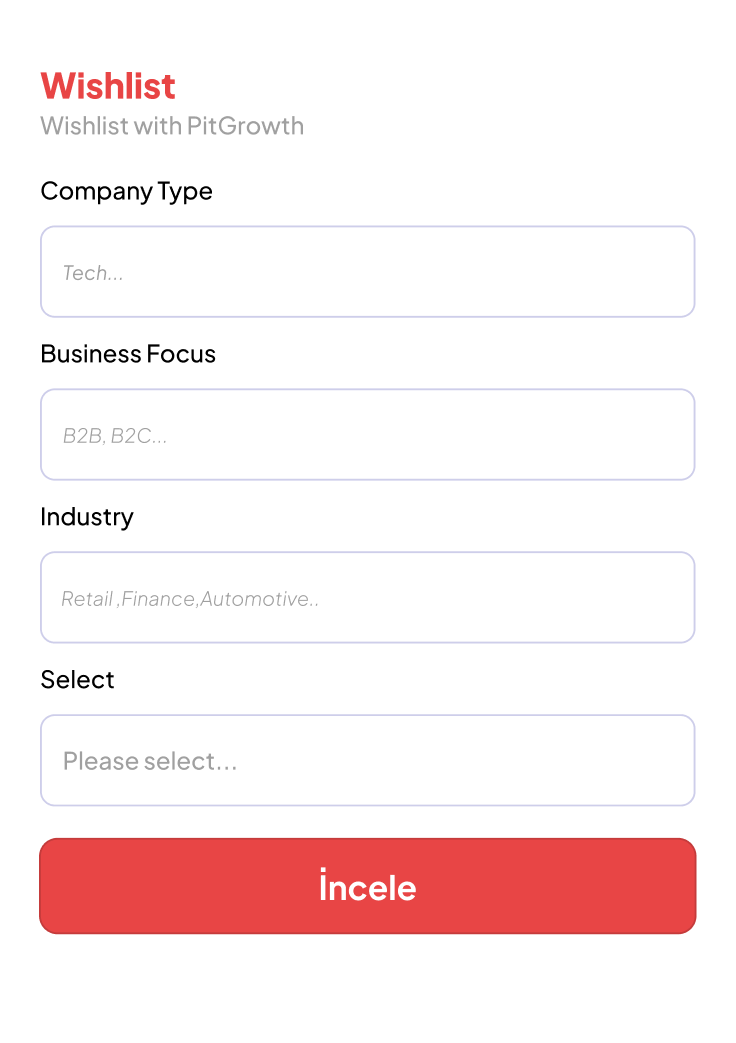

Find Right Partners

Our platform brings together solution providers in the financial technology field to help you establish reliable business partnerships.

Smart Matching

Automatically find solution providers that match your needs

Verified Providers

All solution providers go through identity and qualification verification

Direct Communication

Opportunity to communicate directly with technical experts and decision makers

Success Tracking

Monitor the performance of your solution implementations

Real-World Use Cases

Discover how leading companies leverage financial technology to drive business success

Enhancing Cross-Border Payment Efficiency

A major retail bank sought to reduce settlement times and associated fees for international transfers to improve customer service and operational throughput.

Key Benefit

Implementation of a blockchain-based payment solution reduced transaction latency by 90% and cut compliance costs significantly, allowing for faster global remittance.

Deploying Embedded Finance Solutions

A large e-commerce provider needed to integrate flexible credit options (Buy Now Pay Later) directly at checkout to boost conversion rates and customer loyalty.

Key Benefit

Successful integration of a leading FinTech lending platform resulted in a 25% increase in average order value and enhanced customer retention through flexible financing options.

How It Works

Find the right business partner and build strong connections in 4 simple steps.

Register

Add your company information and create your profile

Define Needs

Specify the criteria for the business partner you are looking for

Connect

Get in touch with suitable companies

Start Partnership

Make an agreement and start your partnership

Average Process Timeline

Time from registration to successful partnership

Frequently Asked Questions

Common questions about implementing financial technology solutions

How can corporates benefit from Fin-Tech adoption?

Corporates benefit from faster transactions, improved compliance, and enhanced customer experience. Fin-Tech platforms also reduce operational costs and enable access to innovative services like embedded finance and digital wallets.

What’s the value for Fin-Tech startups on the platform?

The platform provides direct access to corporates, banks, and investors actively looking for solutions. Startups can validate products, secure partnerships, and scale faster by showcasing references and case studies.

Can SMEs adopt Fin-Tech solutions cost-effectively?

Yes, many Fin-Tech platforms are subscription-based or usage-based, making them accessible to smaller businesses. SMEs can implement payment gateways, invoicing tools, and credit scoring systems without heavy upfront costs.

How does the platform verify Fin-Tech vendors?

Vendors undergo verification through client references, regulatory compliance checks, and case studies. Only trusted providers with proven market performance are listed on the platform.

What KPIs should corporates track with Fin-Tech projects?

Transaction speed, fraud detection rate, cost savings, customer adoption, and overall ROI are critical KPIs that measure the impact of Fin-Tech adoption.